Middleton Ma Real Estate Tax Rate . the highest fy2023 residential tax rate is longmeadow ($22.92) while the lowest fy2023 residential tax rate is edgartown. Please visit our website at: Please visit our website at: total assessed property values by property class as reported to dls by city and town boards of assessors. Board of assessors | middleton, ma (middletonma.gov) for further. Board of assessors | middleton, ma (middletonma.gov) for further. the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. the mission of the board of assessors and it's staff is to value real and personal property in accordance with the laws of the commonwealth of. the 2024 tax rate $11.79. over half of middleton's real estate tax payments are made by mortgage companies on behalf of property owners. the 2024 tax rate $11.79.

from realestatestore.me

the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. Board of assessors | middleton, ma (middletonma.gov) for further. Please visit our website at: over half of middleton's real estate tax payments are made by mortgage companies on behalf of property owners. the 2024 tax rate $11.79. total assessed property values by property class as reported to dls by city and town boards of assessors. Board of assessors | middleton, ma (middletonma.gov) for further. the mission of the board of assessors and it's staff is to value real and personal property in accordance with the laws of the commonwealth of. Please visit our website at: the highest fy2023 residential tax rate is longmeadow ($22.92) while the lowest fy2023 residential tax rate is edgartown.

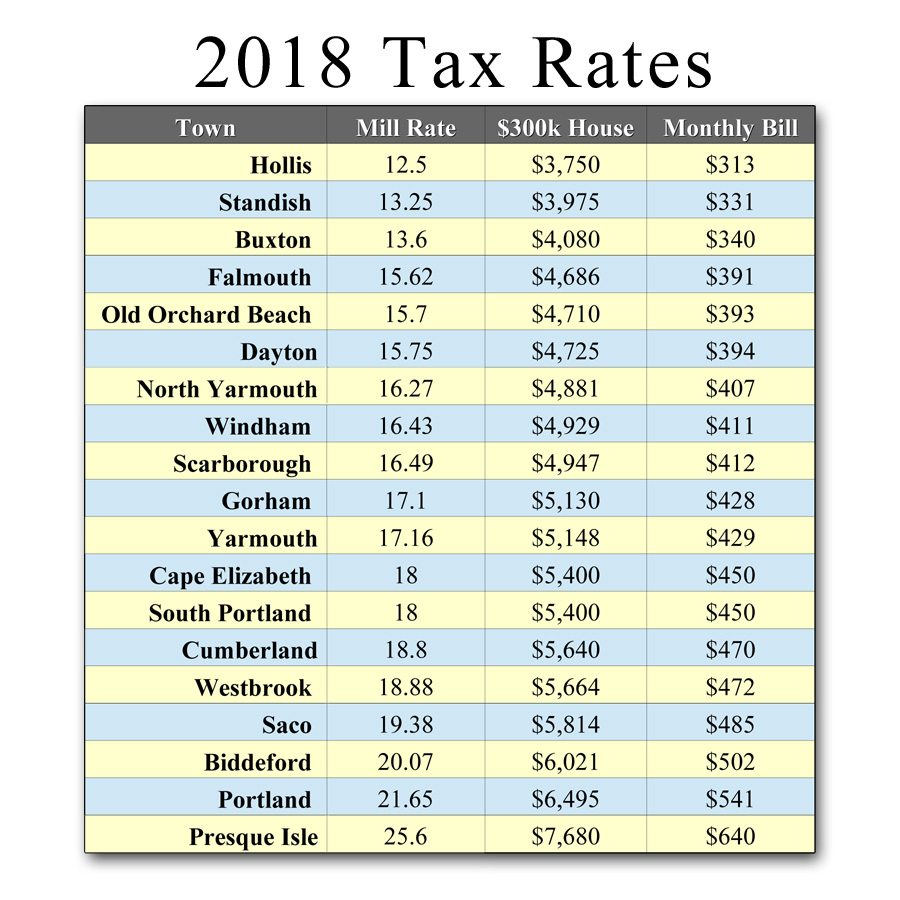

2018 Property Taxes The Real Estate Store

Middleton Ma Real Estate Tax Rate Board of assessors | middleton, ma (middletonma.gov) for further. total assessed property values by property class as reported to dls by city and town boards of assessors. the highest fy2023 residential tax rate is longmeadow ($22.92) while the lowest fy2023 residential tax rate is edgartown. the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. Board of assessors | middleton, ma (middletonma.gov) for further. the 2024 tax rate $11.79. the 2024 tax rate $11.79. Please visit our website at: Board of assessors | middleton, ma (middletonma.gov) for further. the mission of the board of assessors and it's staff is to value real and personal property in accordance with the laws of the commonwealth of. Please visit our website at: over half of middleton's real estate tax payments are made by mortgage companies on behalf of property owners.

From dennabroyles.blogspot.com

massachusetts commercial real estate tax rates Denna Broyles Middleton Ma Real Estate Tax Rate the mission of the board of assessors and it's staff is to value real and personal property in accordance with the laws of the commonwealth of. Please visit our website at: the 2024 tax rate $11.79. over half of middleton's real estate tax payments are made by mortgage companies on behalf of property owners. the property. Middleton Ma Real Estate Tax Rate.

From www.realtor.com

Middleton, MA Real Estate Middleton Homes for Sale Middleton Ma Real Estate Tax Rate Please visit our website at: the mission of the board of assessors and it's staff is to value real and personal property in accordance with the laws of the commonwealth of. Board of assessors | middleton, ma (middletonma.gov) for further. the property tax rates are determined by each individual town and every year, towns in massachusetts publish a. Middleton Ma Real Estate Tax Rate.

From exoknbrmt.blob.core.windows.net

Middleton Property Taxes at Jerry McCartney blog Middleton Ma Real Estate Tax Rate the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. Please visit our website at: the highest fy2023 residential tax rate is longmeadow ($22.92) while the lowest fy2023 residential tax rate is edgartown. the 2024 tax rate $11.79. Please visit our website at: total assessed. Middleton Ma Real Estate Tax Rate.

From cosasmayas.blogspot.com

massachusetts real estate tax rates by town Very Strong EJournal Middleton Ma Real Estate Tax Rate the highest fy2023 residential tax rate is longmeadow ($22.92) while the lowest fy2023 residential tax rate is edgartown. over half of middleton's real estate tax payments are made by mortgage companies on behalf of property owners. Please visit our website at: the 2024 tax rate $11.79. the 2024 tax rate $11.79. total assessed property values. Middleton Ma Real Estate Tax Rate.

From exoockuei.blob.core.windows.net

Mendon Ma Real Estate Tax Rate at William Brand blog Middleton Ma Real Estate Tax Rate the 2024 tax rate $11.79. Please visit our website at: Board of assessors | middleton, ma (middletonma.gov) for further. total assessed property values by property class as reported to dls by city and town boards of assessors. the highest fy2023 residential tax rate is longmeadow ($22.92) while the lowest fy2023 residential tax rate is edgartown. the. Middleton Ma Real Estate Tax Rate.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet Middleton Ma Real Estate Tax Rate the mission of the board of assessors and it's staff is to value real and personal property in accordance with the laws of the commonwealth of. Please visit our website at: the highest fy2023 residential tax rate is longmeadow ($22.92) while the lowest fy2023 residential tax rate is edgartown. Board of assessors | middleton, ma (middletonma.gov) for further.. Middleton Ma Real Estate Tax Rate.

From exowfumzq.blob.core.windows.net

Milford Ma Real Estate Tax Rate at Dale Stewart blog Middleton Ma Real Estate Tax Rate over half of middleton's real estate tax payments are made by mortgage companies on behalf of property owners. the mission of the board of assessors and it's staff is to value real and personal property in accordance with the laws of the commonwealth of. the property tax rates are determined by each individual town and every year,. Middleton Ma Real Estate Tax Rate.

From exouaedjw.blob.core.windows.net

Hamilton Ma Property Tax Rate at Susan Erhart blog Middleton Ma Real Estate Tax Rate Please visit our website at: the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. the 2024 tax rate $11.79. Please visit our website at: the mission of the board of assessors and it's staff is to value real and personal property in accordance with the. Middleton Ma Real Estate Tax Rate.

From joes.homes

Moving To Middleton, MA Middleton Real Estate & Things You Should Middleton Ma Real Estate Tax Rate the highest fy2023 residential tax rate is longmeadow ($22.92) while the lowest fy2023 residential tax rate is edgartown. the mission of the board of assessors and it's staff is to value real and personal property in accordance with the laws of the commonwealth of. the 2024 tax rate $11.79. Please visit our website at: total assessed. Middleton Ma Real Estate Tax Rate.

From www.realtor.com

Middleton, MA Real Estate Middleton Homes for Sale Middleton Ma Real Estate Tax Rate the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. the 2024 tax rate $11.79. the highest fy2023 residential tax rate is longmeadow ($22.92) while the lowest fy2023 residential tax rate is edgartown. Board of assessors | middleton, ma (middletonma.gov) for further. over half of. Middleton Ma Real Estate Tax Rate.

From www.realtor.com

Middleton, MA Real Estate Middleton Homes for Sale Middleton Ma Real Estate Tax Rate Board of assessors | middleton, ma (middletonma.gov) for further. Please visit our website at: over half of middleton's real estate tax payments are made by mortgage companies on behalf of property owners. the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. Please visit our website at:. Middleton Ma Real Estate Tax Rate.

From exowfumzq.blob.core.windows.net

Milford Ma Real Estate Tax Rate at Dale Stewart blog Middleton Ma Real Estate Tax Rate the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. Board of assessors | middleton, ma (middletonma.gov) for further. total assessed property values by property class as reported to dls by city and town boards of assessors. over half of middleton's real estate tax payments are. Middleton Ma Real Estate Tax Rate.

From www.neighborhoodscout.com

Middleton, MA, 01949 Crime Rates and Crime Statistics NeighborhoodScout Middleton Ma Real Estate Tax Rate the 2024 tax rate $11.79. total assessed property values by property class as reported to dls by city and town boards of assessors. Board of assessors | middleton, ma (middletonma.gov) for further. the mission of the board of assessors and it's staff is to value real and personal property in accordance with the laws of the commonwealth. Middleton Ma Real Estate Tax Rate.

From dennabroyles.blogspot.com

massachusetts commercial real estate tax rates Denna Broyles Middleton Ma Real Estate Tax Rate the 2024 tax rate $11.79. over half of middleton's real estate tax payments are made by mortgage companies on behalf of property owners. Board of assessors | middleton, ma (middletonma.gov) for further. the 2024 tax rate $11.79. total assessed property values by property class as reported to dls by city and town boards of assessors. . Middleton Ma Real Estate Tax Rate.

From exoahpusb.blob.core.windows.net

Sutton Ma Property Tax Rate at Margaret Bell blog Middleton Ma Real Estate Tax Rate Please visit our website at: the highest fy2023 residential tax rate is longmeadow ($22.92) while the lowest fy2023 residential tax rate is edgartown. the 2024 tax rate $11.79. total assessed property values by property class as reported to dls by city and town boards of assessors. Board of assessors | middleton, ma (middletonma.gov) for further. Board of. Middleton Ma Real Estate Tax Rate.

From suburbs101.com

Massachusetts Property Tax Rates 2023 (Town by Town List with Middleton Ma Real Estate Tax Rate the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. Please visit our website at: Board of assessors | middleton, ma (middletonma.gov) for further. the 2024 tax rate $11.79. the highest fy2023 residential tax rate is longmeadow ($22.92) while the lowest fy2023 residential tax rate is. Middleton Ma Real Estate Tax Rate.

From www.realtor.com

Middleton, MA Real Estate Middleton Homes for Sale Middleton Ma Real Estate Tax Rate Board of assessors | middleton, ma (middletonma.gov) for further. Please visit our website at: the 2024 tax rate $11.79. Please visit our website at: the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. total assessed property values by property class as reported to dls by. Middleton Ma Real Estate Tax Rate.

From exowfumzq.blob.core.windows.net

Milford Ma Real Estate Tax Rate at Dale Stewart blog Middleton Ma Real Estate Tax Rate total assessed property values by property class as reported to dls by city and town boards of assessors. the 2024 tax rate $11.79. Board of assessors | middleton, ma (middletonma.gov) for further. the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. the mission of. Middleton Ma Real Estate Tax Rate.